Announcement:

Buffalo City School District has selected the services of a new outside firm to handle the administration of our flexible spending accounts (FSA) benefits. The new vendor, Total Administrative Services Corporation (TASC) will begin providing service on 9/1/24. Information about these changes has been mailed out.

This move to TASC will not change your benefits in any way. It simply means that you will now communicate with TASC instead of P&A Group. Here is the timeline for our transition:

Date | Action |

8/31/2024 | Last day to file manual claims with P&A Group. FSA cards through P&A Group will be deactivated. Questions about your account with P&A can be directed to P&A at 1-800-688-2611, Mon. thru Fri. 8:30 am to 10:00 pm. |

9/1/2024 – 10/6/2024 | Blackout period – no FSA processing during this time. This is to ensure all outstanding claims with P&A Group are processed, and accurate account information is sent to TASC. Keep your receipts during the blackout period! You can submit a request for reimbursement starting 10/7/2024. |

10/7/2024 | Your account with TASC is now ready. Information on how to access your account will be sent before this date. Cards will be mailed in a white, non-descript envelope during this week. |

Questions & Answers

Flexible Spending Account

The Flexible Spending Account (FSA) program is a benefit that enables you to SAVE MONEY by placing pre-tax dollars in an account for unreimbursed healthcare or dependent care expenses. Employees determine the amount to contribute for the year via payroll deductions. The plan year runs from January 1st through December 31st

HERE’S HOW IT WORKS

Employees estimate their expenses for the upcoming year, and complete & submit the FSA enrollment form during Open Enrollment. Effective January 1st, the employee will have access to a TASC Group debit card and web portal to submit claims associated with qualified expenses for the calendar year. The pre-tax contribution lowers your personal taxable income, and subsequently, tax withholdings.

There are two types of Flexible Spending Accounts:

Health Care FSA’s

Dependent Care FSA’s

Please be advised Flexible Spending Accounts are regulated by the IRS

IRS substantiation guidelines have tightened up. Participants will be receiving more frequent claim substantiation requests to ensure the plan funds are being utilized appropriately. Although an FSA debit card does a good job weeding out most ineligible items/services, there are times when eligible providers provide ineligible services (for example, teeth whitening at a dentist or Botox at a doctor's office). Please note that documentation should be kept for all claims, even if it is not requested, as it will be needed in the event of an IRS audit.

Enrollment

Initial enrollment must occur within 30 days of hire or during the open enrollment period (November 1st – November 30th). Employees determine the amount to contribute for the year via payroll deductions. It is called your annual election. This amount will be pro-rated over the remaining pay periods in the plan year (January 1 - December 31) for newly hired employees or for those who are enrolling due to life-changing events at a time other than the beginning of the calendar year.

Flexible Spending Account 2025 Enrollment Form for New Hires

EXAMPLE - If you enroll in in October and choose a max amount of $2500, your deductions are calculated using the paychecks you are receiving for the remainder of the calendar year (October, November and December).

Flexible Spending Accounts Information

Health Care FSA

A Health FSA is so much more than Doctor and Prescription Co-Pays. It’s also for regular expenses associated with:

OTC medicine and drugs such as allergy, sinus, cold, and flu products

OTC supplies such as skincare products & sunscreen, bandages, contact lens solution & supplies, feminine care products, first aid supplies, pregnancy tests, and reading glasses

Prescriptive glasses and contact lenses (even prescriptive sunglasses)

Home medical devices such as blood pressure monitors, glucose tests & monitors breast pumps & accessories, and CPAP accessories

TASC-FSA-Eligible-Expenses.pdf

2025 Limits:

Maximum annual election - $3,300 maximum

Minimum annual election - $200 minimum

You must incur eligible expenses between January 1st and December 31st to be reimbursed from the amount you contribute to your Health Care FSA during your plan year. There is a $660 Roll-over feature. Up to $660 in unused funds can roll from one plan year to the next. Any excess funds in excess of $660 will be lost. Rollover funds will become available on your TASC Card in April even if you do not re-enroll for the following year. Separation from service is the only circumstance that would prevent you from utilizing the rollover funds in the future.

All eligible expenses must be incurred by December 31st. If you choose to use paper Reimbursement Claim Forms, they must be submitted by March 31st.

Dependent Care FSA

Expenses that are eligible for reimbursement include such items as childcare and eldercare services. The Dependent Care FSA can help you pay your eligible out-of-pocket dependent care costs. Expenses are limited to household services or the care of one or more qualifying individuals (i.e., a dependent child less than age 13 or a dependent adult), while you are at work.

2025 Limits:

Maximum annual election - $5,000 (if single or if married and filing jointly)

Maximum annual election - $2,500 (if married and filing separately)

Minimum annual election - $200

The Dependent Care Flexible Spending Account plan has a grace period of 75 days. This means that any funds from your previous years' account remaining after December 31st can be used for any qualifying purchase for up to 75 days in the following year.

Reimbursement Claim Forms must be submitted by March 31st.

TASC Child & Dependent Care FSA-Eligible-Expenses.pdf

LIFE QUALIFYING EVENTS

Qualifying life events can occur that alter your necessary Flexible Spending coverage. The birth of a child, marriage, or a change in employment, will all affect coverage for your FSA plan. When such an FSA qualifying event occurs, you are allowed to make a mid-year election change to your FSA. Use the enrollment form at the top of the page to create an account or change your annual limit. Detailed information can be found by clicking HERE.

RESOURCES TO DETERMINE IF AN FSA IS RIGHT FOR YOU!

When you enroll in an FSA, you receive the TASC Group Benefits Card. This is a convenient debit card that can simplify the process of paying for eligible expenses under your FSA, such as co-payments, prescriptions, glasses, dental expenses, and more.

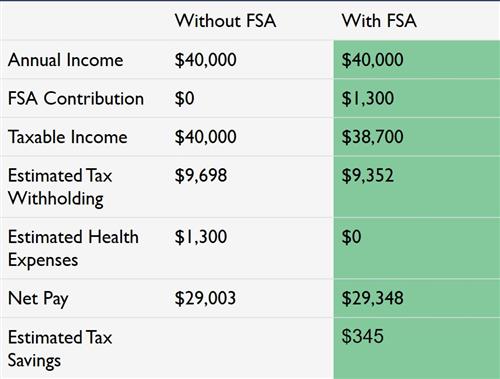

The matrix below is an example of how enrollees save money with a Flexible Spending Account. Estimate how much YOU CAN SAVE per year by using this online TASC FSA Calculator

Here is the where you can find additional information on eligible expenses. If you are unsure if an expense is eligible for reimbursement, please call TASC at 800-422-4661, M-F, 8-5.

How do I know that my store will accept my FSA Debit Card for medical expenses? Use this Store Locator to identify a list of providers that accept the Benefits Card.

Provider: TASC

Telephone: 800-422-4661, M-F, 8-5.

Website: https://www.tasconline.com/

TASC provides a Participant Portal to help you manage your accounts. Registration directions can be found in the Related Links below.